Financing Renewable Energy: Supporting Low-Carbon Economic Development and Fighting Climate Change

Winrock’s work with partners in Asia and Africa builds on a legacy of support for renewable energy, helping to spur increased investment and sustainable economic development.

Kathmandu perches at an elevation above 4,300 feet in Nepal inside a valley rimmed by the Himalayas. Its population of 1.4 million is growing at about 4% each year. As the teeming city expands, its energy consumption and greenhouse gas emissions are also rising. At one point in 2021, Kathmandu ranked among the top 10 most polluted cities in the world, according to The Himalayan Times.

Lagos, Nigeria’s commercial capital, sits just above sea level on the Gulf of Guinea. The West African megacity’s population is ballooning. At 26 million and counting, it now ranks among the largest urban centers in the world and boasts the biggest economy of any African city, fueled in part by oil production.

But growth comes at a cost. Residents in and around Lagos are coping with increasingly poor air quality, the result of emissions from booming refineries, cement, chemical, steel, iron-smelting factories, and other sources, including the city’s notorious traffic. According to the World Bank, the smog is causing severe public health impacts.

Meanwhile, Nepal is experiencing changes in temperature and precipitation over the global average, impacting agricultural production, food security, and water access, and increasing stress on forests and biodiversity. Air quality in Kathmandu and across the country is affected by aging vehicles, industrial emissions, smoke from wood and other biomass-fueled fires for cooking, and trash burning.

These two countries on two different continents are confronting the same conundrum: how to balance their growth and pursuit of improved livelihoods against the global struggle to reduce pollution and slow the pace of climate change.

With funding from donors including the French Development Agency (AFD) in Nigeria and the U.K.’s Foreign, Commonwealth & Development Office (FCDO) in Nepal, Winrock is working with the governments of both countries, as well as a range of private and public sector partners, on separate projects to spur new investment and attract increased access to financing for expanded use of renewable sources of energy. The goal: moving toward a cleaner energy future and battling climate change by reducing reliance on heavily polluting energy sources.

Winrock facilitates and promotes the use of solar, wind, hydro, biofuels, energy efficiency and other increasingly cost-effective sources of clean energy as a way to increase access to energy services for the 1.6 billion without electricity and to enable countries to adopt low emission pathways for economic development. Winrock uses market-driven approaches to expand the use of clean energy to achieve social and economic development. Historically low prices of solar energy and other renewables have opened opportunities to increase the productivity of smallholder farmers and green national power grids. Read more about it here.

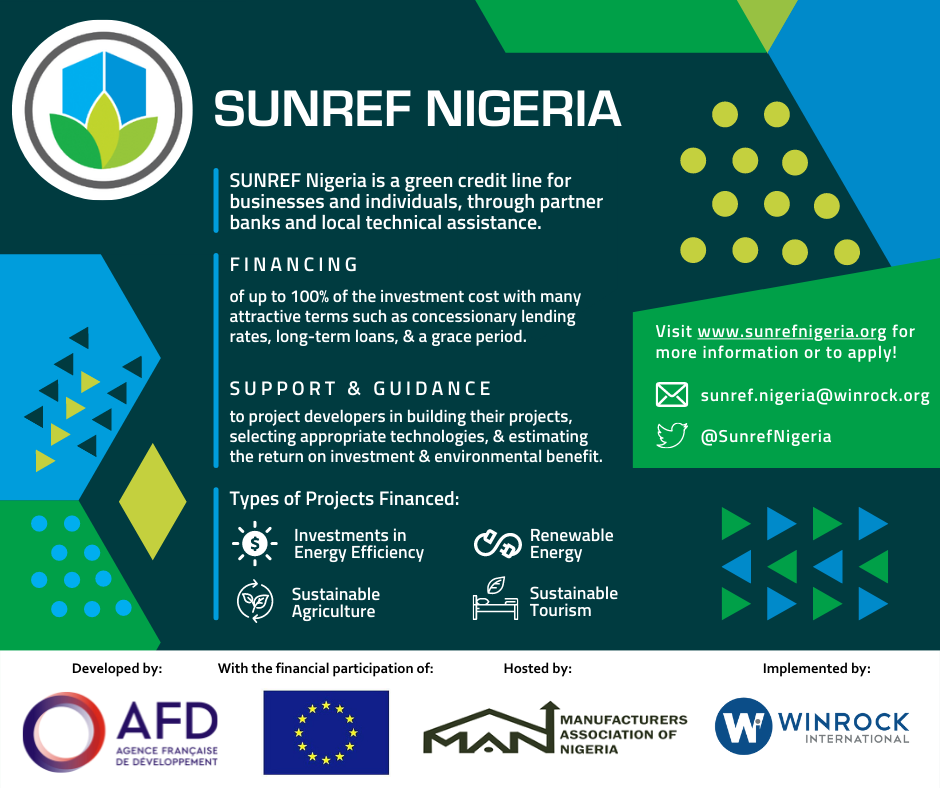

The two distinct activities are priming the pump for increased investments into sustainable, lower-carbon economic development by reducing financial risks in both countries. The Sustainable Use of Natural Resources and Energy Finance (SUNREF) project in Nigeria is facilitating easier access to affordable loans for innovative clean energy conversion or expansion, while the Nepal Renewable Energy Programme channels investments that help to buy down costs associated with transitioning to cleaner fuels, beginning in people’s kitchens – with cookstoves. The NREP activity is currently implemented by DAI Global with Winrock and others in close collaboration with Nepal’s government.

Launched in 2020, the SUNREF project, implemented with the Manufacturers Association of Nigeria and two Nigerian banks, has drawn interest and applications from dozens of private sector businesses, organizations, and industry stakeholders seeking affordable loans. They want help converting aging, inefficient power systems and industrial equipment to renewably powered or cleaner production.

In June 2022, SUNREF announced the first loan approved through its program, which includes a 10% grant, to the Lagos Business School. The financing will enable installation of a 350-kilowatt solar project to reduce the school’s skyrocketing energy costs and is expected to cover approximately 60% of the institution’s electricity requirements.

While dozens of Nigerian businesses and other entities have expressed interest in SUNREF, the school is the first to receive all necessary approvals for a loan from one of the facility’s two financial partners, Access Bank. Issued at 9% interest with an eight-year repayment period, the terms are viewed as affordable in Africa’s nascent renewable energy financing sector.

Lagos Business School “students will see the solar canopy whenever they look up,” Gavin Greenway, who leads Access Bank’s project and structured finance group, told The Guardian newspaper in Nigeria. “This will send a powerful message to the next generation of how we must power our future. Whilst Africa is a negligible CO2 emitter globally, its resolve to go green will signal to the world how seriously it takes responsibility for its own emissions. We see SUNREF as just the opening phase of a larger, pan-African masterplan from Access Bank.”

Sub-Saharan Nigeria and landlocked Nepal are both imperiled by climate change and are already feeling its impacts keenly. TIME magazine in 2021 ranked Lagos the fourth most vulnerable city in the world to climate change. Without a reliable power grid and lacking access to the finance needed to pay for transitioning to solar, wind, hydropower, and cleaner-burning fuels, most Nigerians use what’s handy: diesel fuel. Nepal has similar environmental challenges, along with the added one of geography, cupped as it is between two of the world’s largest greenhouse gas emitters: China to the north and India to the south.

Renewable energy has great potential to help both countries sustainably grow their economies, reduce poverty, diversify energy supplies, meet climate goals, and build societal resilience, says Bikash Pandey, Winrock’s director of clean energy. But he adds: “Without credit, you don’t solve the big problems of climate change – it’s a very knotty issue ─ one of the long-term and most difficult problems to resolve.”

Activities like SUNREF and NREP spur investment in renewable energy by generating evidence that helps close the viability gap. “You’re demonstrating increased viability so that down the line, the sector becomes completely commercial, and the banks are making these investments themselves, without subsidies,” Pandey says.

So far in 2022, NREP has facilitated investments that are helping to fund nine different renewable energy projects in Nepal. Those include five projects that promote electric cookstoves, enabling people to shift from wood/liquefied petroleum fuels through a credit financing model in partnership with microfinancing institutions (MFIs). The projects will promote uptake of 50,500 electric cookstoves in the Madhesh, Lumbini and Karnali provinces. So far, 3,500 stoves have been installed, replacing stoves that use polluting fuel sources.

Another project underway, also with a partner MFI and credit financing model, is promoting distribution of solar water pumps. Other initiatives include installation of two captive solar projects of 100 kilowatt peak (kWp) and 26 kWp, respectively, emplaced on the roofs of one industrial and one trading company building. A rural electrification project in Karnali, home to both Nepal’s largest national park and largest lake, will extend an existing solar mini-grid by 50 kWp to provide clean power to an additional 54 households and three enterprises.

Through the Sustainable Energy Challenge Fund (SECF), a funding mechanism in Nepal’s Alternative Energy Promotion Centre supported by NREP, the project also has provided 20% guarantees for two loans provided by commercial banks for two additional rooftop solar installations.

Total investments for NREP projects so far tally about $474,089, and have leveraged just over $3 million, along with public investments of $11,264, says Prem Sagar Subedi, NREP’s deputy team leader.

NREP builds on Winrock’s long history of supporting research, programs, and innovative financing approaches to grow Nepal’s renewable energy sector.

“Winrock has been implementing and actively carrying out research on renewable energy projects in Nepal for the last 24 years,” says Badri Baral, director of Winrock’s Renewable Energy Program Support Office in Nepal. Winrock recently completed a study in Nepal that provided evidence of increased interest in and uptake of cleaner e-cooking amongst low-income, peri-urban households. In 2006, Winrock helped facilitate startup of the country’s first bank dedicated to renewable energy ventures. The bank enables Nepalese investors, hydropower, and other sustainable energy firms and ventures to find financing more easily.

A few times zones away on Africa’s west coast, SUNREF is also making a difference.

The French approach with SUNREF has previously helped to expand renewable energy investments in other countries in Africa, as well as some Asian countries, says Ogechi Adiuku, a clean energy expert working with Winrock in Nigeria. The loan to Lagos Business School is just the first of many more to come, Adiuku says, with dozens of additional proposals for clean energy conversion submitted and under review. These include energy efficiency projects such as replacement of existing heating systems, rehabilitation of boilers, steam distribution and compressed air systems, installation of variable-speed drives on electric motors and heat recovery, and implementation of energy management systems at a wide range of industrial facilities.

With a total of $70 million in financing available for renewable energy transition in Nigeria, Javier Betancourt, SUNREF Nigeria’s team leader, says the project and its partners are eager to identify and help fund additional initiatives.

“The application process is very simple: simply apply on our website,” Betancourt told The Guardian Nigeria. “Once the SUNREF Nigeria team finds your project eligible, it is reviewed by either Access Bank or UBA [United Bank for Africa], who are our partner banks, according to their credit risk review criteria. The loan application is approved if it meets the criteria.”

Related Projects

SUNREF Nigeria

The Sustainable Use of Natural Resources and Energy Finance (SUNREF) Nigeria project seeks to improve access to affordable finance for renewable energy and energy efficiency technologies, a critical step to increase economic opportunities, reduce carbon emissions, create employment, and ultimately promote sustainable development in Nigeria. These outcomes will be achieved by removing the barriers to […]